※Position at time of interview

Catching all traces of money laundering—the passion of a specialist in blockchain analysis

Chainalysis Inc. provides blockchain data and analysis to government and financial institutions and cryptocurrency exchanges in over 40 countries.

Cryptocurrency involves breakthrough technologies with great implicit potential. However, the anonymity of users and the instantaneous transfer of funds across national borders are also lures for malicious uses. Chainalysis exposes the unauthorized flow of funds, and contributes to the detection of financial crimes worldwide. Various countries have started to strengthen their regulations and implement policies to further expand their surveillance networks.

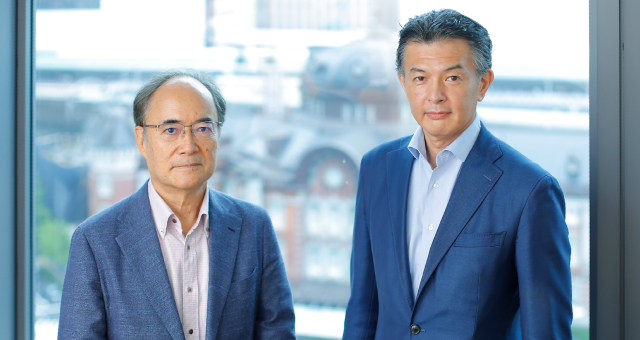

The Japan branch of Chainalysis was established in June 2020, and their office is located in EGG JAPAN. We asked Mr. Hayato Shigekawa, Sales Engineer at Chainalysis, about the work done there to discover and deal with financial crimes and illegal flows of cryptocurrencies, and the solutions Chainalysis provides to contribute to their deterrence.

Chainalysis boosts the trustworthiness of cryptocurrencies

Bitcoins and other cryptocurrencies are already well-known in Japan. However, news stories have reported on financial crimes in this sector, casting a negative light.

Chainalysis provides expertise in blockchain analysis, and support to the government institutions and cryptocurrency exchanges necessary for these core institutions to take actions in fighting crime.

Mr. Tanaka stated that a key aspect of PriceHubble is that it provides visual materials for understanding RE prices. “Our idea was not only to present RE prices themselves in a visible form, but also quantifications related to life in the area of the house, population trends, and so on.”

Mr. Shigekawa explains, “Cryptocurrencies differ from existing legal currencies, which are governed by a central bank, and circulate via the financial sector. There are no central managing entities for cryptocurrencies. They circulate within a decentralized system, and funds are not sent through any established financial intermediaries.”

Bitcoins first emerged in 2009. This pioneering cryptocurrency is said to have been born out of repellence to financial institutions and the governments that attempted to bail them out due to their reckless operations, which consequently led to a financial crisis. While the “father” of bitcoins is a person named Satoshi Nakamoto, this individual has yet to be identified.

“The bitcoin system was created as a means of circumventing existing centrally managed monetary systems,” continues Mr. Shigekawa. “To ensure the secure management of financial transactions, financial institutions incur major costs, including compliance aspects. This results in considerable commission and other costs for users. Because the bitcoin system has no central authorities, users can cheaply and speedily send funds via the Internet to another party, who may be in-country or abroad.

This convenience, however, is offset by the anonymity of the transaction, which means that this system could also be and is used for criminal purposes.”

The founders of Chainalysis are also founding members of the first cryptocurrency exchange. At a time when there was no regulation whatsoever of cryptocurrencies, these persons became aware about the the existence of darknets where trade in illegal goods and transactions take place. Chainalysis was thus founded as a means of bolstering trust and reliability in cryptocurrencies.

The Mt. Gox incident, which led to the founding of Chainalysis

The Mt. Gox incident, also reported in Japan, was a factor in the founding of Chainalysis. During the Mt. Gox exchange, huge amounts of bitcoins vanished, which caused worldwide shocks.

Mr. Shigekawa continues, “Chainalysis tracked the lost bitcoins within blockchains, working cooperatively with United States law-enforcement agencies. This cooperative investigation forged a relationship of trust between Chainalysis and law-enforcement and authorities such as the FBI, and led to the expansion of the company.”

Additionally, the Chainalysis founders worked closely with bankruptcy trustees during the Mt. Gox incident and its aftermath. With access to the entire database, the company found transactions that were not recorded within the database, and accordingly pursued the whereabouts of these unrecorded funds. The lost amounts were traced via exchange records, a portion of which led back to Mt. Gox itself.

Thereafter, the company developed advanced tracking tools for cryptocurrency transactions. In addition to the provision of these tools for actual cases of cryptocurrency breaches, Chainalysis expanded into consulting, support, and other related services as well.

“We provide solutions for compliance and investigations related to cryptocurrencies. Our work at Chainalysis makes visible what is actually occurring within blockchains.”

Chainalysis clients include law enforcement agencies, cryptocurrency exchanges, and financial institutions.

“Our solutions for cryptocurrency exchanges are provided in the form of transaction monitoring tools, which enable exchanges to ascertain whether exchange members are conducting any transactions with suspected illegal entities. We offer similar solutions for our private sector customers, including financial institutions. Bank accounts are used when in the buying and selling of cryptocurrencies, so this poses potentially high risks for banks as well. We provide financial institutions with tools for ascertaining and clarifying such risks.”

Chainalysis solutions are thus a type of “software as a service” (SaaS) system, which are provided to users in the form of annual subscriptions.

Detection of addresses where malicious use of blockchains can occur

We asked Mr. Shigekawa about the technologies that originally made cryptocurrency transactions possible.

“These were extremely revolutionary, as they enabled multiple unidentified participants to operate and manage monetary systems on the Internet. This was done without any need for the central governing authorities necessary in the case of conventional financial systems, which are extremely complex. Blockchain technologies made this possible.”

Transaction ledger management is an important part of existing financial transactions. As these ledgers increase in scale and complexity, errors and irregularities can more easily occur. Strict regulations and compliance measures consequently become necessary for financial institutions.

“Blockchains enable the decentralization of these systems. They are characterized by the fact that any and all transaction ledger overwrites never disappear from the system.”

A grouping of transaction data is called a “block.” These blocks are joined in a chain comprised of time-series linkages.

“Any attempt to tamper with data within a blockchain results in data inconsistencies in all data, such that the chain no longer holds. Any attempt to willfully correct these inconsistencies simply aggravates the problem due to the sheer amount of data that has to be corrected, making such attempt factually impossible. This unique characteristic of blockchains ensures that data can be maintained for unspecified numbers of participants without occurrence of irregularities.”

An “address” is used when transferring funds in cryptocurrency transactions. This mechanism also differs from inter-account transactions occurring at existing financial institutions.

“In any transfer of funds from one account to another in a financial institution, there is clear identification of the sender and the recipient. In contrast, addresses used in cryptocurrency transactions are nothing but combinations of alphanumeric characters, and they do not include any information that could identify account holders or the persons making the transactions. Although the records of addresses for all transactions occurring within a blockchain are public information, individuals cannot be identified by investigating these addresses. So, it bears repeating that while cryptocurrency transactions are transparent due to their being publicly disclosed information, anonymity is still secured at the same time.”

Addresses used in cryptocurrency transactions are not limited to single-person holders, in that the same person or even groups could have multiple addresses.

“This fact is a hurdle in tracing the flow of funds in cryptocurrency transactions. However, Chainalysis addresses these problems through ‘clustering’ and ‘identification.’ Clustering is the grouping of multiple addresses connected with a single entity, and identification is the discernment of the entity that owns a cluster.

The use of Chainalysis’s massive cluster-identification information and sophisticated tools enables the clarification of what kind of services and funds are flowing into an entity from investigated addresses. These identified services not only include legal services, but also illegal ones involving sanctioned entities, darknet markets, ransomware, etc.”

In this way, Chainalysis solutions are used to detect fund flows into suspicious addresses along a blockchain and are thus expected to contribute to criminal investigations and an anticipated reduction of crime.

Additional contributions to asset seizures in darknet markets

Chainalysis currently has offices in six cities around the world: New York City, Washington D.C., Copenhagen, London, Singapore, and Tokyo. Around 200 persons work for the company worldwide. There are close tie-ups with the law enforcement agencies of each country, and has also been involved in numerous cryptocurrency-related incidents.

“Our company name sometimes appears in official court documents submitted by the U.S. Department of Justice,” states Mr. Shigekawa.

Many cryptocurrency transaction-related court cases occurred in 2020. In one particular case, two foreign nationals in a cybercrime group were subjected to economic sanctions and asset seizures in relation to the laundering of funds hacked from a cryptocurrency exchange.

Another case involved bitcoin donations to a terrorist group. Thanks to an investigation by legal authorities and Chainalysis transaction tracking, the assets of this group were legally seized.

Chainalysis also made significant contributions in other major cases. One was the identification and seizure of USD 1.0 billion in assets of an entity connected with Silk Road, which is known as a dark market from an early period. Another was in resolving a fraud case in July 2020 where Twitter accounts of celebrities including IT entrepreneurs were hacked to solicit bitcoins.

“Japan has also had well-known cases of illegal cryptocurrency outflows, many of which remain unsolved today. Money laundering is an international problem, and Japanese companies throughout the cryptocurrency sector must also improve their risk-response capabilities,” emphasizes Mr. Shigekawa.

Marunouchi is a prime location for companies involved in the financial sector

“When our Japan branch was founded in June 2020, one of my former colleagues who had already been working at Chainalysis talked to me about the company. So, I ended up joining the company in February and we became a tenant of EGG JAPAN in March.”

Japan has the third largest economy in the world, with large financial markets and expanding cryptocurrency markets. Even before the establishment of the Japan branch, Chainalysis already had contacts with Japanese domestic law enforcement agencies and cryptocurrency exchanges. Nevertheless, as the company faced language barriers and differences in business customs and practices, Chainalysis was seeking personnel who could communicate in Japanese.

Since Mr. Shigekawa started his job at Chainalysis, he has been actively involved in global communications and works in close contact with staff around the world.

“Our U.S. offices had to be temporarily closed due to COVID-19, but this was not a major issue as we had already been engaged in online communications as a matter of course even before the pandemic.”

Mr. Shigekawa speaks thus of the advantages and attractions of EGG JAPAN.

“Our work is often said to fall within the fintech [financial technology] sphere, and that makes a reliable and trustworthy office space an absolute must. Additionally, being a financial company, Marunouchi is definitely an optimal location for us.”

Mr. Shigekawa says that he intends to more actively utilize the benefits of this location after the COVID-19 pandemic subsides.

“We want to hold on-site seminars and meetings. There are good seminar and meeting rooms here, which we can easily use. The transportation access is also perfect, so we have high prospects for our EGG JAPAN tenancy.”

Cryptocurrency transactions are expected to experience growth well into the future, which would mean more and more business opportunities for specialized companies such as Chainalysis.

* Reporting for this article was conducted prior to the COVID-19 State of Emergency declaration.

Reporting and Text:Toru Uesaka

Editor:Kanae Maruyama

Photographer:Satoshi Hirayama

Hayato Shigekawa

Mr. Shigekawa has experience working for a major foreign enterprise IT vendor, a foreign cybersecurity start-up vendor, and a consulting company. He joined Chainalysis in 2020. The point of attraction of Chainalysis for Mr. Shigekawa was its free and open atmosphere unique to a foreign start-up, as well as its global business environment.

Chainalysis is a company that specializes in blockchain analysis, and providing compliance and investigation-related software to leading international banks, cryptocurrency enterprises, and government entities. Also, with its expertise in blockchain analysis and combatting financial crime, Chainalysis supports its customers with findings key to their required security and crime-fighting activities.